Hampton Roads Real Estate Market Update 2022

Hello Hampton Roads,

Since 2019, Hampton Roads has experienced a strong seller's market with tight inventory, soaring home prices, bidding wars, and many homes selling over the list price. This trend has continued all through the end of 2021.

Since 2019, Hampton Roads has experienced a strong seller's market with tight inventory, soaring home prices, bidding wars, and many homes selling over the list price. This trend has continued all through the end of 2021.

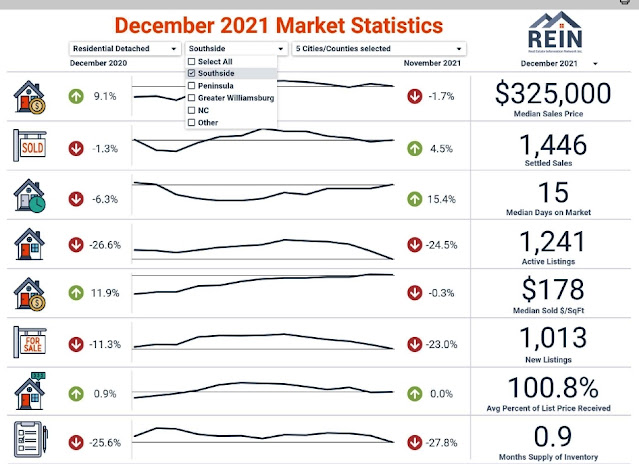

Let's take a look at the latest MLS statistics from December 2021:

The image below shows the numbers for detached homes on the southside and you can that 1446 homes sold in December with a median sales price of $325,000. The median days on market was 15 days with homes selling on average for 100.8% over asking!

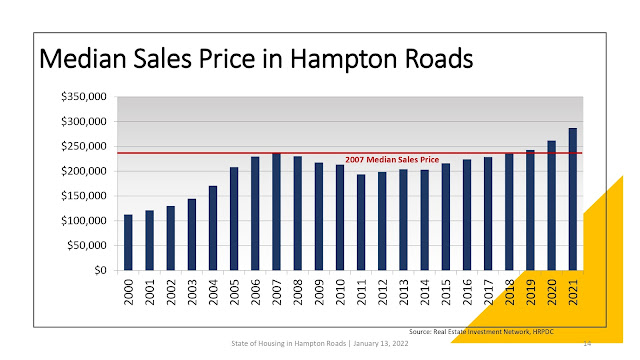

Here's another interesting chart which givces more perspective on price:

The median sales price for all of Hampton Roads residential homes (attached and detached) is now higher than it was during the height of the bubble in 2007. Prices first surpassed this threshold in 2019 and have continued to go higher since.

If you're a home seller, things are looking pretty good but I want to add a cautionery note and let you know that interest rates are expected to rise. At its most recent meeting, the Fed announced that it would stop buying government backed debt as early as March and according to a report from CNBC, the market is now pricing up to 5 rate hikes in the Federal funds rate. The Federal funds rate is the interest rate that banks charge each other to borrow moneyand this can affect mortgage rates becuase if it costs banks more to borrow money, then this extra cost can be passed down to the borrower in the form of higher mortgage rates.So what does all this mean?

Once the Fed stops buying debt especially mortgage backed securities, governmenet back loans (think Fannie and Freddie) become less attractive to lenders because they become harder to sell; i.e. they can't offload the loans to the government anymore. When you also factor in rising interest rates in the picture, this lowers th purchasing power of buyers which could result in a smaller pool of buyers. The bottom line is that less liquidity and rising rates have a cooling affect on the market.

On a positive note, rates are still historically low below 4% and the market is still moving at a brisk pace according the latest statistics mentioned earlier. Ratess are still great for home buyers and homes are selling on average above the list price.

If you are thinking of selling your home in 2022 and you want to take advantage of the market, and sell for top dollar you may want to consider getting a free no obligation soft home inspection. A soft home inspection will give you your home selling score and allows you to see how your home compares to the competition before you put it on the market. Homes with scores 85 or better tend to sell faster and for more money than homes with lower scores.

During the soft home inspection we do a room by room walk-through of your home to get your score and if your score is below 85 you will have a specific list of items you can do to help raise your score. This is a free service I offer to home sellers and the only thing I ask in return is that when you are ready to sell your home you give me the opportunity to earn your business.

You can schedule a call for your Soft Home Inspection here: https://calendly.com/liz-schuyler

If you have any questions about the real estate market, please let me know, I'm happy to help!

Comments