Overcoming The Top 5 Challenges Home Seller Face

Hello Hampton Roads,

Thanks for Reading,

Discover how much your home could sell for in today's market! https://sellers.hamptonroadshomes.us/video

Selling your home can be a rewarding experience, especially due to the fact that the recent pandemic years have given the home owners a whopping 40% appreciation nationally. Home prices are still expected to appreciate but not as rapidly as it did in the past and many owners who are sitting on a lot of equity are now considering selling. However, selling a home is not without its challenges and many sellers may encounter obstacles that require strategic solutions. Let's explore five common challenges and how you can overcome them for a successful home sale.

1. Challenge: Not Understanding the Local Market 🏡

Are we in a buyers market or a seller's market? How close to list price are seller's getting? As more homes come on the market, this means more competition for sellers. How do they ensure their house stands out from crowd?

Solution:

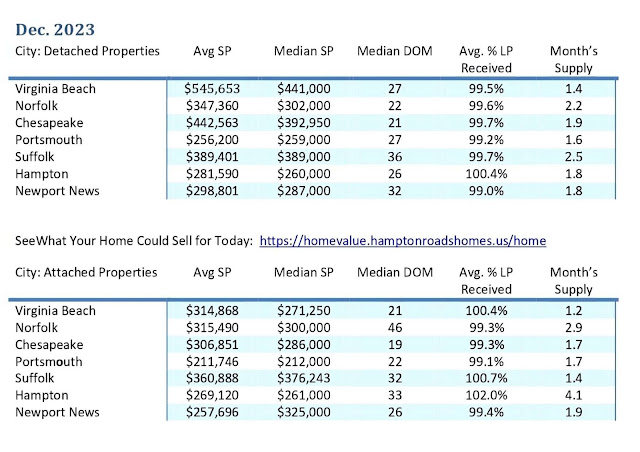

I provide montly stats for both detached and attached homes throughout the 7 cities so you can see how the market is shifting. Take a look at the latest numbers from Dec 2023 here:

This shows you the average and median home price, median days on market (DOM), percentage of LP (list price) to SP (sold price) and months supply of inventory. Looking at the data, months supply of inventory is increasing but we are still in a seller's market. Six months is a balanced market, below 6 months is a seller's market and above 6 months is a buyer's market. Another point of interest is that the best homes are still sell very close to asking or over asking.

2. Challenge: Not Strategically Pricing the Home 💰

What is the best way to price my home to get the best price for it? Should I test the market with a higher price point and then reduce it if it doesn't sell?

Solution:

Over pricing a home never helps; it causes prolonged market time and turns your new listing into a stale listing the longer it sits on the market with not activity. The first 7 days on the market is the golden time when your houses garners the most attention as this it when it has the status of "NEW" in the MLS.

The best way to ensure you get the best price for your home is to see what recent sales of similar houses have been and price it accordingly but you must also make sure your house is in showing condition. Homes that are in showing condition and priced right sell faster and for more money. If you really want to turbo charge the sale, then price it just below what similar homes have been selling for and the market competition will drive up the price.

3. Challenge: Home Inspection Surprises 🕵️♂️

Are the major systems of your house functioning properly? Is there some simple cosmetic fix you can do that will pay big dividends?

Solution:

Conduct a pre-listing home inspection to identify and address potential issues upfront. This proactive approach can prevent surprises during the buyer's inspection. Also walk-through the home with your real estate agent so you can see your home through the eyes of a buyer. If there is a simple cosmetic fix like painting over a repaired roof leak in the ceiling, then it makes sense to take the time and do it . Leaving it only leads to more questions in a buyer's mind about the condition of the rest of the home.

4. Challenge: Qualified Buyers Only Please 👪

Which offer has the best chance of closing? How do I know which pre-approval letter is better?

Solution:

The first differentiation between buyers is whether or not they are pre-qualified or have proof of funds. Serious buyers take the time to get qualified and many sellers do not even entertain offers with a current pre-approval (within 30 days). Not every pre-approval is created equal and as a seller your concern is working with the buyers who have the best chance of closing. This is where your real estate agent comes into play becuase he or she should vet the buyers on your behalf by looking at the types of loans and also speaking with the buyers respective lenders.

When trying to differentiate between pre-approval letters, typically the buyer who is making the larger down payment has more vested in the transaction and therefore more likely to close. They have more financial stability to make the larger downpayment, therefore probably more financially capable of getting loan approval and closing. Cash offers trump financed offers as long as the price is in line with market value or better.

5. Challenge: Negotiation Deadlocks 🤝

Are you negotiating from an emotionally charged point of view or from a more balanced point of view? Are you trying to get 100% of what you want?

Solution:

Don't be so wedded to an outcome that you're not willing to accept something better. Don't be so intractable that you lose sight of the goal. The key is flexibility and open communication. This is another benefit of using a real estate agent to negotiate on your behalf--dealing through a 3rd party means that your offer can be conveyed without your emotional charge. Approach negotiations with an open mind. Be willing to compromise on non-essential points and maintain clear communication with the buyer to find mutually beneficial solutions.

Conclusion: Empowering Sellers in the Face of Challenges 🌟

While challenges may arise during the home selling process, each hurdle presents an opportunity for growth and success. By adopting strategic approaches, sellers can navigate the complexities of today's real estate market with confidence.

Remember, you're not alone in this journey. Consider partnering with a seasoned real estate professional who can provide guidance and expertise to overcome challenges and ensure a smooth and successful home selling experience. If you'd like to talk about your home selling plans and the best way to execute them, you can schedule a free consultation here: https://calendly.com/liz-schuyler

Thanks for Reading,

Liz Schuyler is a top Virginia Beach REALTOR® with RE/MAX Allegiance, licensed since 2001 and trusted across Hampton Roads. With 350+ homes sold, she helps clients Sell, Move, and Invest with confidence and strategy.

_________________________ Discover how much your home could sell for in today's market! https://sellers.hamptonroadshomes.us/video

Comments