Hello Hampton Roads,

If you're in the market to buy a home today you know it's tough out there! You've saved and worked hard to be able to buy and when you finally find a home you like, chances are you will still be competing with other buyers. So today I want to talk about why homes are still selling quickly inspite of higher mortgage rates and what you can do to help with housing affordability. Ready to learn how to navigate this market to help you buy a home? Let's go!

Expectations vs. Reality

The expectation was that mortgage rates would be trending lower this year and housing prices would normalize and drop too. However, the reality is that mortgage rates now stand at 7.5% and sold home prices in Hampton Roads are up 5.4% from a year ago! Inflation has proven to be sticky and there's less demand for treasuries so interests rates have to go up. Mortgage rates which follow the 10yr Treasury have increased and housing affordability is at an all time low.

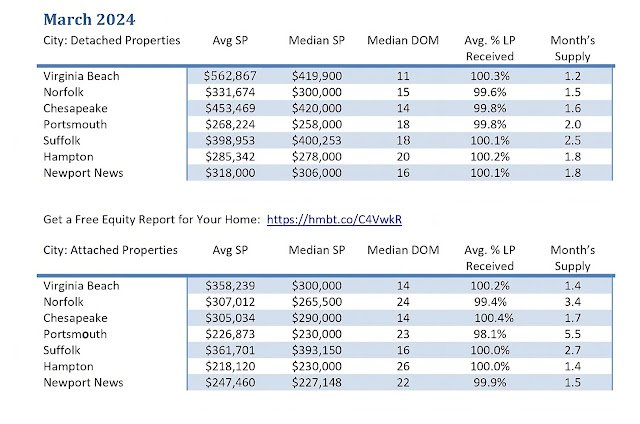

Here's what's happening in the local real estate market. Check out the latest stats of sold homes for March 2024 below:

Though more homes are starting to come on the market, the best ones sell in a matter of days and over over asking indicating competing offers driving up the price. So in spite of higher rates and fewer buyers in the market, there is still not enough homes to meet demand and I attribute this to the lock in effect.

The Lock-in Effect: I Could Sell but Then Where Would I Live?

The lock-in effect is when home owners are unwilling to sell their current homes because current mortgage rates aren't as good as what they have and doing so would potentially put them in a mortgage expensive mortgage for a lesser house. I've heard lots of home owners say, I could sell, but then where would I live? They feel locked in to their current rate and this prevents new inventory from coming on the market. According to a

Redfin article, 4 in 5 home owners with mortgages have a rate below 5%, 62% have a rate below 4% and 23.5% have a rate below 3%.

What You Can Do if You're Buying a Home

You can and should put yourself in the best position to buy. This means, choose the best home buyer programs for your specific situation, mind your credit score, work with a buyer's agent for professional representation and negotiate smart strategies when making an offer on a house.

- Home Buyer Programs: If you are not yet pre-approved for financing, look into different programs to help with housing affordability. There are low and no down payment programs for eligibles buyers to help with the down payment and even closing costs. Funding can be in the form of a loan or a grant. Remember grants don't have to be paid back so don't ignore free money! Some programs require you to be a 1st time home buyer while others do not.

- Credit Score: The minimum credit score required for most programs is a 620 but higher scores give you more options. Once you are qualified for a loan avoid these deal killers: Keep your credit clean with no lates or charge offs, don't quit your job, don't open new credit or take out a loan, don't close any existing accounts, don't spend large sums of money, and don't take a credit card cash advance.

- Professional Representation Pays: Work with an agent who is knowledgeable about the market, who knows about the upcoming changes taking effect this summer that affect buyers and sellers (NAR Settlement effect) and who can also help you review the different home buyer programs, make sure you are not overpaying for a home and negotiate with your best interests in mind. Remember the seller's agent and the builder's agent do not represent you-- their job is to negotiate the best deal for their client.

- Smart Negotiation Strategies: Last but not least, there are smart negotiation strategies that can be used to help your home purchase be more affordable. Depending on your situation here are a few strategies to consider: Negotiating concessions with the seller to permanently buy down the rate (lender credit) or doing a temporary buy down (3,2,1 or 2-1 buy down) and or to cover your cash out of pocket (closing costs). If you are lucky enough to have significant cash to put into the transaction, you can also have your agent find out if the curren't owner's loan is assumable and if it makes sense to do so. VA and FHA loans are assumable.

If you want to learn more about the current market or need help navigating the buying or selling process, I'm offering a free consultation where we talk about all these things and more and come up with a personalized plan to help you achieve your real estate goals. You can schedule a quick intro call here:

https://calendly.com/liz-schuyler

Comments