Common Home Buyer Myths

Hello Hampton Roads,

Myth #2 It's Cheaper to Rent Than Own

With all the moving parts between contract and closing buying a home in today's market can be overwhelming, not to mention full of misconceptions and myths. Today, I thought we'd take a look a some common home buyer myths and separate fact from fiction!

Myth #1 You Need a 20% Down Payment to Buy a Home

Having the money for the down payment is a major cause of stress for future home owners and according the a Lending Tree survey, about 27% of first time buyers believe it is the majot obstacle holding them back from buying. While a larger down payment will reduce your monthly payment, there are several loan products available to first time home buyers and repeat home buyers alike that require far less. Popular first time home buyer programs in Hampton Roads offer both zero down and low down payment options and grants.

Myth #2 It's Cheaper to Rent Than Own

Is it really cheaper? It depends on what you're paying in rent. It's true that housing prices have shot up since the pandemic but so have rental prices and on a percentage basis, rental prices have gone up higher than sales. If you could own for what you pay in rent, it may be worth it to buy especially if you plan on being the in the area for a few years. Why pay someone else's mortgage, when you can pay your own?

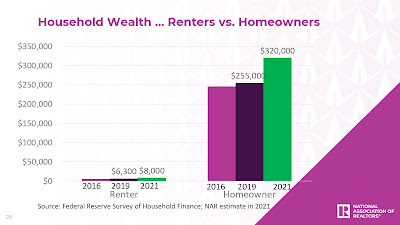

Additionally the long term gain in household wealth in terms of owning can't be overlooked. Take a look at the table below comparing the household wealth of renters vs owners. This is the data form the Federal Reserve Survey of Consumer Finance which is done every 3 years and the green bar is the NAR's (National Association of Realtors) lateset estimate.

Myth #3 You Need a High Credit Score

It's a common misconception that buyers need a high credit score in order to buy, but the fact is that home buyers may qualify for a low downpayment FHA loan with a minimum score of 620 and a low downpayment conventional loan with a score as low as a 640. While these are the minimum scores, buyers with higher scores are offered more attractive rates and may even avoid MI (mortgage insurance) with a lower downpayment. For example with Virginia Housing's conventional loan program buyers with scores of 680 don't pay any MI.

Myth #4 Interest Rates Are Too High to Buy a Home

It's true that interest rates have been going up and are expected to go up until the Fed gets inflation under control. Mortgage rates started out in the beginning of the year in the low 3'% range and now sit in the mid 5% range. While no one wants to borrow money at a higher interst rate, what is the cost of waiting if rates are expected to go up?

Higher rates price out a lot of home buyers from the market but fewer buyers leads to less competition which leads to more inventory which leads to longer market times which leads to price reductions. This is what we are starting to see and this bodes well for the buyers who are still in the market.

If uou have any questions about the home buying process and want to talk about your specific plans, I'd love to chat! https://calendly.com/liz-schuyler

Comments