Hello Hampton Roads,

If you’re looking to buy a house, one of the first things you’ll need to do is make sure your credit score is up to snuff. The better your score, the better rates and terms you’ll get and for most home loans, the minimum credit scores required is a 620 middle score. Some lenders may have additional requirements aka"lay-overs" making their minimum a little higher, like 640 but for the most part, you will the minimum credit score requirement range from a 620 to a 640.

That's great news if you score is already at the minimum or higher; but what if your credit score isn’t great? How can you drastically improve it so you can buy the house of your dreams?

The good news is that improving your credit score is easier than you think!

Here's some simple tips on how to do it:

Check Your Credit Reports

The first step to improving your credit score is to check your credit report. You can get a free copy of your credit report from each of the three major credit bureaus – Experian, TransUnion, and Equifax. In fact, you can go to AnnualCreditReport.com and at this time they are offering free weekly credit reports from each of the bureaus! These reports will show you the accounts each bureau is reporting. Once you have your report, check it for accuracy. Make sure there are no errors or outdated information on it. If you find any mistakes, contact the credit bureau and have them corrected.

Pay Your Bills on Time

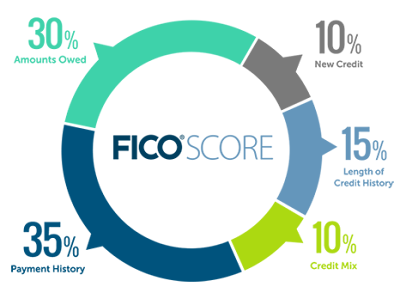

Your payment history is one of the most important factors in determining your credit score. If you’re not currently keeping up with your payments, start now. Set up automatic payments for all your bills so you don’t have to worry about forgetting to pay them. When you go to apply for a mortgage you want to make sure that you don't have any late payments showing up.

Reduce Your Credit Card Balance

Your credit utilization ratio is another important factor in determining your credit score. This is the amount of credit you’re using compared to the amount of credit available to you. Ideally, you want to keep your credit card balance below 30% of your credit limit. So if you have a $1,000 limit, you want to keep your balance below $300

Establish Credit But Don’t Open Too Many Accounts

It's important to have established credit but opening too many accounts in a short period of time can hurt your credit score. This is because it signals to lenders that you’re desperate for credit and not managing your finances well. If you're just starting out, start with getting a secure card from your bank. Your bank will issue you a card that is secured by money you have on deposit with them. You'll start out with a lower credit limit but as you use this responsibly and pay it back on time, you'll see your score can quickly rise.

Don't Close Old Accounts

Closing old accounts can also hurt your credit score. This is because it reduces your total amount of available credit, which increases your credit utilization ratio. Also the length of time you've had these accounts will also help your score. So if you have old accounts that you’re no longer using, it’s best to keep them open.

By folowing these simple tips, you can drastically improve your credit score and get yourself in a better position to buy a house. With a higher credit score, you’ll be able to get better rates and terms, which can save you thousands of dollars in the long run.

So don’t wait any longer – start taking steps today to improve your credit score and get yourself in position to buy the house of your dreams. If you'd like to talk about your home buying plans and the best way to get started, let's chat: https://calendly.com/liz-schuyler

Thanks for Reading,

_________________________

Free On Demand Training on How to Buy a House in Hampton Roads:

Comments